How Home Insurance Claims Work

This will be a multi-part blog entry highlighting the most frequently asked questions of a Homeowners Insurance Claim.

Part 1: Understanding the Insurance Adjusters Report.

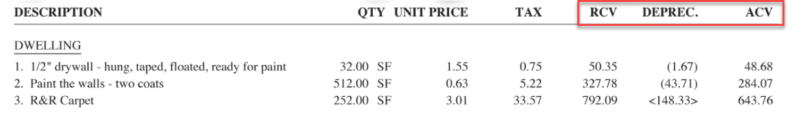

The adjusters report is a line item estimate prepared by the Insurance Adjuster showing replacement cost per room of your home.

There are three main columns to the Adjusters report.

- RCV – Replacement Cost Value. The estimated cost of repairing a damaged item or replacing an item with a similar one.

- ACV – Actual Cost Value. The estimated value of the item or damage at the time of the loss. Generally, ACV is calculated as Replacement Cost Value (RCV) minus Depreciation.

- Depreciation – Loss of value that has occurred over time due to factors such as age, wear and tear, and obsolescence. If depreciation is recoverable, the amount is shown in ( ). If depreciation is not recoverable, the amount is shown in < >.

Above we see that drywall is paying $50.35 for full replacement. The initial check that arrives with the adjusters report will be the total of the ACV column less your deductible. When the contractor completes the project, they will submit a line item invoice for all items that were replaced or repaired in the Depreciation column that are recoverable.

Now lets look at R&R Carpet. R&R stands for “Remove and Replace”. The carpet is paying $792.09 to remove the carpet and replace with new. Notice the Deprecation is in < >, meaning the deprecation is not recoverable due to this is an item that is expected to wear over time and will be replaced. So the actual payout for the carpet is the ACV of $643.76 as the depreciation is not recoverable.

Calculating depreciation

Generally, depreciation is calculated by evaluating an item’s Replacement Cost Value (RCV) and its life expectancy. RCV represents the current cost of repairing the item or replacing it with a similar one, while life expectancy is the item’s average expected lifespan.

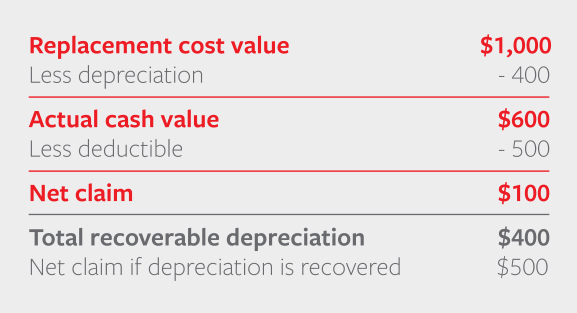

For example, let’s say your laptop was destroyed in a flood. You bought the laptop two years ago and it was in normal condition for its age before the flood. A similar laptop is sold in stores today for $1,000 (the RCV). This laptop has a life expectancy of five years, meaning it loses 20% of its value each year. Because your laptop was two years old, it had lost 40% of its value before being destroyed by the flood. Therefore, the actual cash value (i.e., the value at the time of the loss) of your laptop is $600. Here is the calculation:

This calculation method also applies to most of the structural components of your dwelling or building that wear out over time, such as the roof. If your dwelling has a 25-year composition shingle roof, it would depreciate at 4% a year under normal conditions. If the roof is 10 years old at the time of your loss and it requires replacement, we would subtract 40% depreciation (10 years x 4% a year) from your replacement cost estimate to determine the ACV of your roof.

Please keep in mind that the condition of an item may also factor into the depreciation calculation.

Your potential reimbursement is governed by the replacement cost. Please keep in mind that when repairing or replacing an item, you can recover only the amount you actually spend. For instance, in our earlier example we determined the RCV of your laptop was $1,000. If you purchase a replacement laptop for $900 and submit a request for the recoverable depreciation, The Insurance company will reimburse you $300 – the difference between the ACV of your previous laptop ($600) and the cost of your new one ($900). If you find that you cannot repair or replace damaged or destroyed item(s) for the replacement cost established on your estimate, you would need to contact your Claim professional before repairing or replacing the item(s).

The rules that apply to your laptop are the same that apply to your kitchen cabinets, flooring, sinks, faucets, etc.